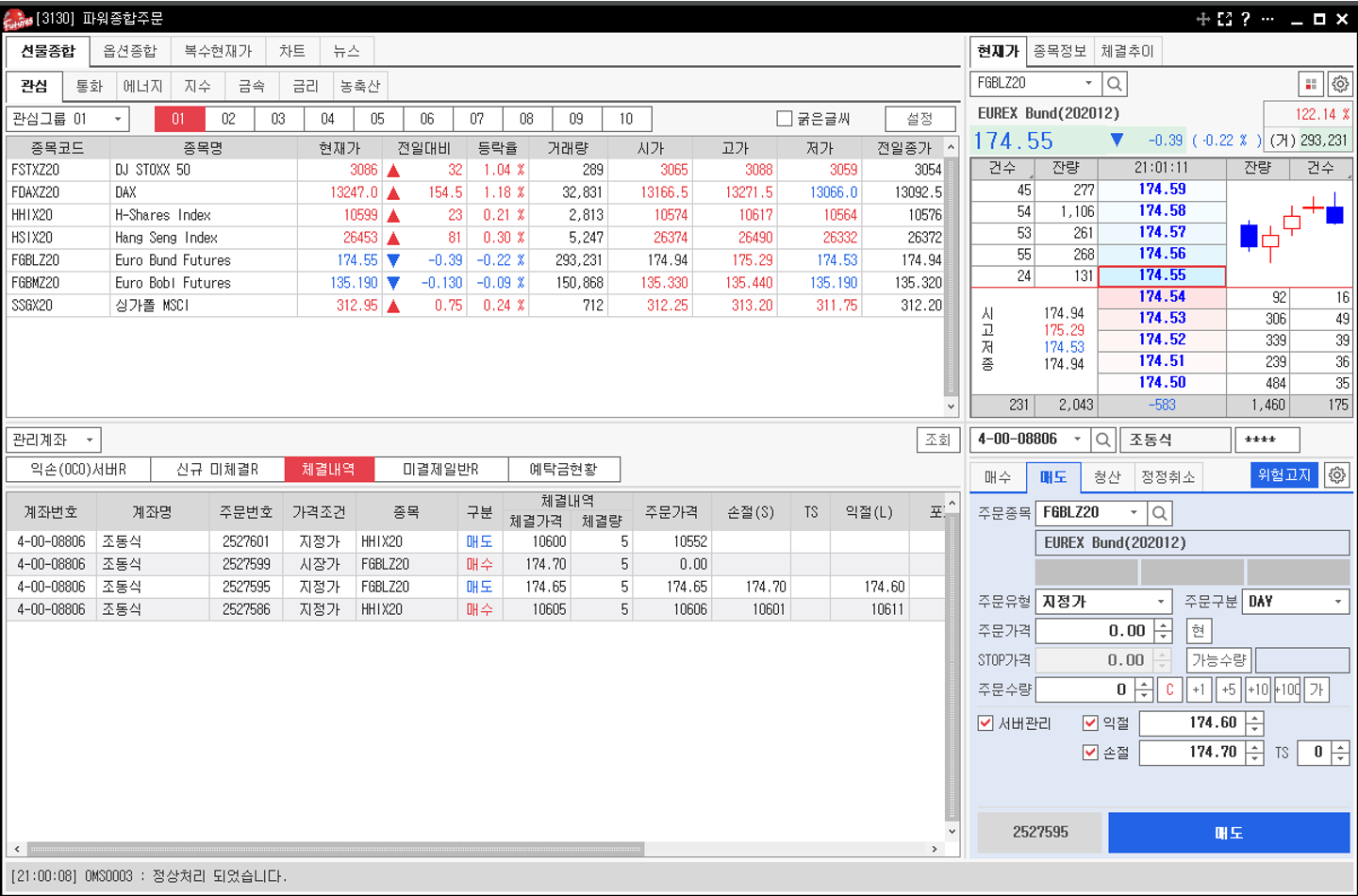

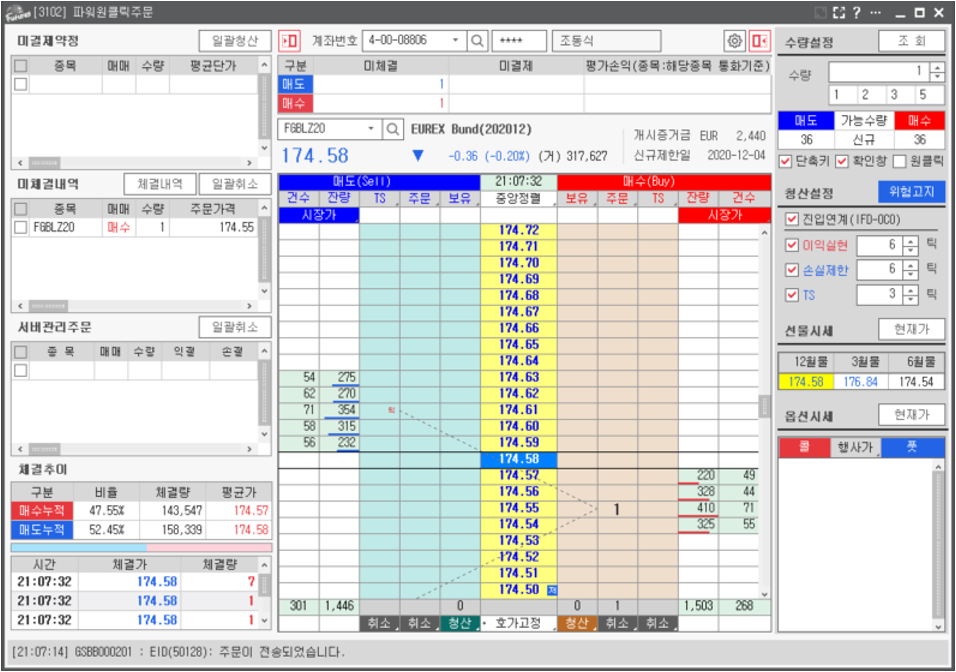

HTS

Comprehensive Order Book

One-click order

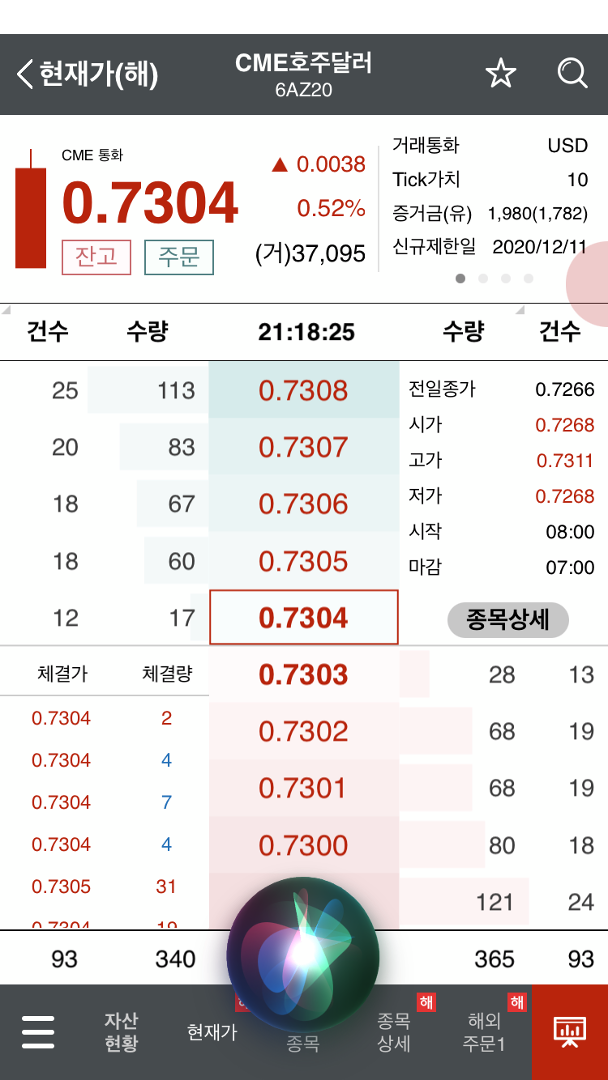

MTS

Order

Favorites

Market Data

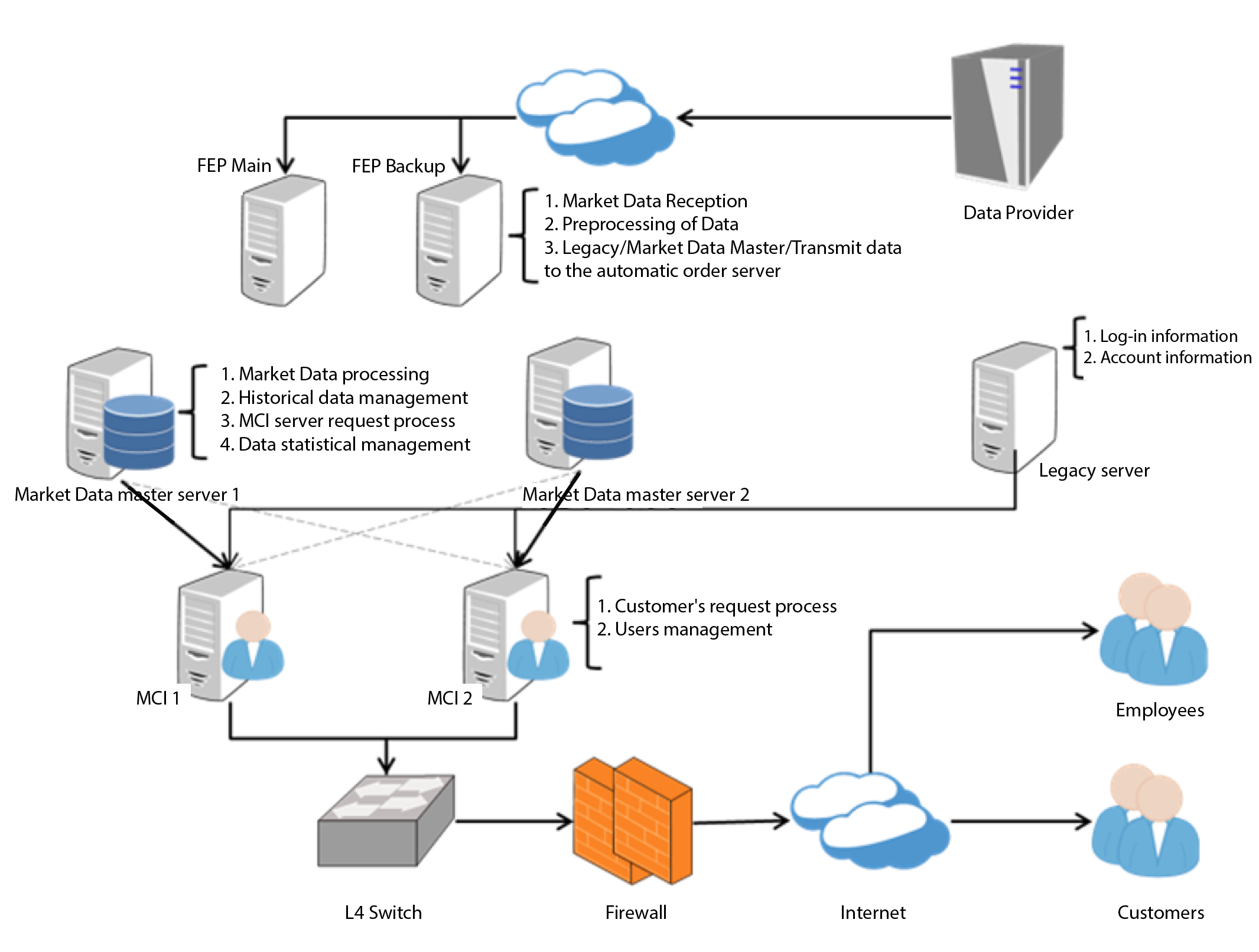

Market Data system

Market Data flow

Primary features and advantages

Extendability

- Flexible System of further Market/Vendor changes. Minimize the development scope of additional change

- Provides API sets for the market data for Future/Option, etc.

- Configuration modification is able to respond adding exchanges without program modification

- Minimize the range of development up to the changes/additions of data vendor(Requires additional development of stream data format processing only)

Modularity

- Clear separation of Business layer, Data processing layer, and Communication layer

- Each module is independent to respond to the changes of development environment and requirements

- Quick and flexible respond to business logic changes including adding new features, changing requirements, etc.

Provide Real-time Market Data

- Real-time Data processing with minimum latency

- Available to set-up the data retention period about each tick/bar

Dynamic Configuration

- Provides independent set-up for individual stock market

- Communication methods for receiving Market data, Protocol setting, and Data retention period setting

- Data retention period setting

- Time zone setting by each exchange

- Trading hour setting

- Batch Process processing time setting

- Watch dog setting: Data receive condition/Error report(SMS)

- Database setting(CISAM, Altibase, MongoDB)

Event Scheduler

- Open/Close/Close price process and Batch Job scheduling by each exchange

- Holiday management by each exchange

Various Database Support

- CISAM, Alitbase, MongoDB(NoSQL) __

- Database accessible in a single API set

Monitoring

- Monitoring data reception status by each exchange

- Immediate administrator notification when the error occurs

Ledger System

- Global futures and options Portfolio margin, Total-risk margin, Margin simulation

- Risk Array File reception and monitoring for the Portfolio margin calculation

- Settlement price, future margin, FND, LTD information ledger automatic reflection

- Corporation customor settlement, transaction separation and create the separate sales/purchases report

- Management of providing real-time Market Data by each User ID and exchange

- CME Seoul Hub DMA: Direct reception of real-time price and order management(CME Group of ISV)

- Calendar Spread Orders

- Variational margin, Realtime Risk Amount, Physical Delivery, futures and options maturity automatic covering

- FIFO netting account and targeting closing Hedge account

- Post margin account, margincall respite account

- Server to Server API, Client API

- Algorithm orders including OCO, IFDone, IFDone OCO, MIT, Stop, Trailing Stop through OMS.

- Income statement order by each account through RMS

- Automatic currency exchaning tool for the accounts have foreign currency margin and variational margin

- Multiple FCM by products and accounts

- Preventing orders mistaken including orders from order and open limits

- CME Group Audit Trail

- Premium option and future option

- Physical delivery and Reservation of Option exercise

- Option management : exercise and assignement process

- Capital gains tax calculation

- Option CAB

- Simulated investment system and contract engine

- Modification of historical value error